In-Person Payments

Process payments wirelessly, giving you complete payment flexibility within the practice.

We're modernizing payments by offering integration with leading dental solutions, FREE wireless smart terminal, simple flat rates, no contracts, and zero monthly or yearly fees.

Get StartedProcess payments to your smart wireless terminal, create automatic payment plans, manage your in-house memberships, automate insurance reimbursements, and collect outstanding balances by text, email, or through your website.

Schedule a Demo

Crown gives you 7 convenient ways to collect payments.

Process payments wirelessly, giving you complete payment flexibility within the practice.

Quickly take payment over the phone and store the patient's cards on file for future use.

Spread out patient treatment costs with flexible recurring payments. You set it up, and Crown will do the rest.

Better serve your uninsured patients, increase your production, and grow your revenue. In-house membership plans have never been more accessible.

Say goodbye to chasing down payments by phone or paper statements. Give your patients the convenience to pay outstanding balances online via text or email.

Automate reimbursements issued by insurance companies via virtual credit card or check (Open Dental only).

Link to a payment page from your statements or website, giving your patients an easy way to self-service an outstanding balance.

The world’s first smart wireless and contactless terminal has created a standard for an impeccable payment experience for dental practices and their patients. Accept all the latest payment technology anywhere, including your operatories!

Schedule a Demo

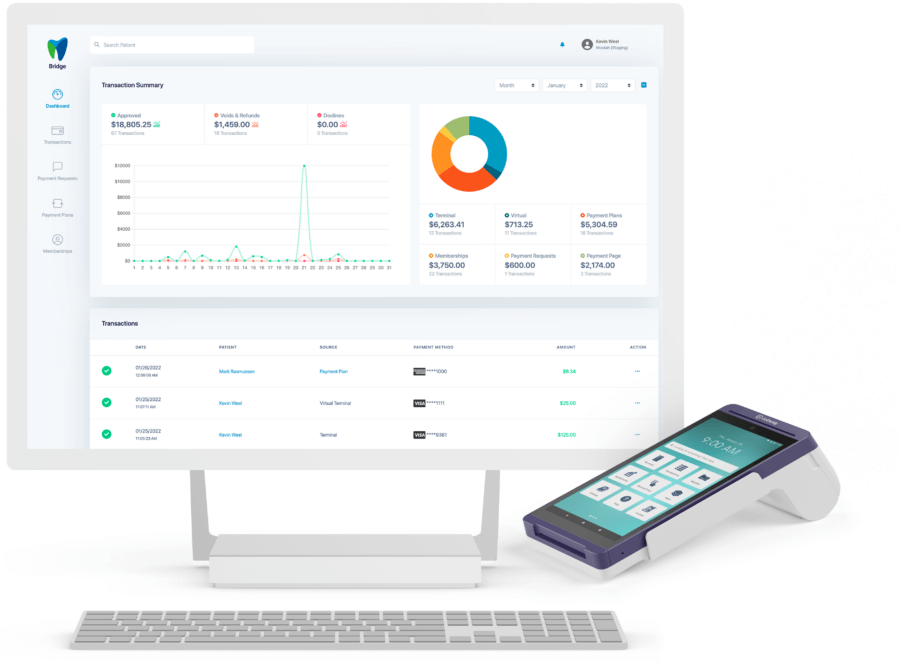

View your transactions, deposits, generate reports, get real-time statistics, and more, all via mobile, web, or on your terminal.

Get StartedEverything is included under our simple flat rates, with no hidden fees or contracts.

We take the guess work out of what you're paying. All in-practice and online transactions process under simple flat rates.

Zero start up costs, we include a smart wireless terminal at no additional cost.

Store patient cards, process payments virtually, setup automatic payment plans, manage your in-house memberships, and send payment requests via text and email.

Your credit card transactions processed today are in your bank account the next business day.

No long PDF applications, or personal credit pulls, your account is setup and live within minutes.

No more annual PCI questionnaire or yearly/monthly assessment fees, everything is handled on your behalf.

Your Moolah account has direct integration with leading dental solutions, included at no additional cost.

No more entering payments into Open Dental manually. Every payment processed in Crown is automatically added to your patient's ledger, this includes allocating payments to procedures!

We integrate with Dentrix G7. Every payment processed in Crown is automatically added to your patient's ledger.

We enable FlexPay! Process payments to your wireless terminals, create automatic recurring payment plans, store patient cards, and send payment requests online all without having to leave Flex..*

* Requires a Flex subscription. For US businesses only. Surcharge program currently not supported.

All accounts include no monthly or annual fees, no equipment or software to purchase, and no contracts.

Our online application only takes minutes. If you have questions, please contact us at 800-625-1670.

Get StartedThank you for scheduling. If you have any questions, please contact us at 800-625-1670.

A credit card surcharge is an additional fee added to a transaction when a patient chooses to pay with a credit card. The surcharge is intended to help offset the cost of credit card processing and applies only to eligible credit card transactions.

No. Debit card transactions may not be surcharged under any circumstances, even if the debit card is processed as a credit transaction or entered manually.

Yes. Credit card surcharges may not exceed the merchant’s actual cost of accepting credit cards and are capped at a maximum of 3% of the total transaction amount, in accordance with card-network rules and applicable law.

Yes. Card networks require clear and transparent disclosure of any credit card surcharge. Practices must notify patients through appropriate signage at the practice entrance, point of sale, and anywhere payments are accepted. If payments are accepted online, the surcharge must also be clearly disclosed on the practice’s website.

Yes. Some U.S. states and territories prohibit or restrict credit card surcharging. Practices are responsible for understanding and complying with their state’s specific requirements before implementing a surcharge.

No. While Moolah provides tools and general guidance to support credit card surcharging, compliance with all applicable laws and card-network rules is the responsibility of the merchant. Moolah does not provide legal advice and assumes no liability for a merchant’s compliance.

Most major credit card networks permit surcharging when done in accordance with their rules, but additional requirements or restrictions may apply. Practices should ensure they have completed all required network notifications and disclosures prior to enabling surcharging.

Failure to comply with surcharging rules may result in card-network fines, required refunds, or other enforcement actions. Practices should ensure they fully understand all applicable requirements before applying a surcharge.

Flex does not currently offer built-in support for credit card surcharging. If a practice chooses to enroll in a surcharge plan, payments would need to be processed through Moolah’s payment platform, which is designed to support surcharging and integrates directly with Open Dental.

If you are considering introducing a credit card surcharge for your patients, it is important to understand that there are specific rules and regulations that must be followed when enrolling in and operating under a surcharge plan.

This article provides a general overview of common surcharging requirements. This content is provided for informational purposes only and does not constitute legal advice. It is the responsibility of each merchant to review, understand, and comply with all applicable laws, card-network rules, and regulatory requirements, including notification timeframes, signage requirements, surcharge percentage limits, and jurisdictions where surcharging is prohibited.

If you are unsure about the laws or regulations applicable to your practice, you should consult with qualified legal counsel. Moolah assumes no liability for a merchant’s compliance or non-compliance with credit card surcharging rules or regulations.

Transparent Communication

Card networks, including Visa, Mastercard, Discover, and American Express, require merchants to clearly and transparently disclose when a credit card surcharge is applied.

Practices must clearly notify patients of a credit card surcharge through appropriate signage placed at the practice entrance, at the point of sale or terminal, and anywhere payments are accepted. If payments are accepted online, surcharge disclosures must also be clearly visible on the practice’s website. All disclosures must inform patients that the surcharge applies only to credit card transactions.

Surcharge Limits

Credit card surcharges must comply with both card-network rules and applicable law. The surcharge amount may not exceed the merchant’s actual cost of accepting credit cards and may not exceed 3% of the total transaction amount.

Card-network rules cap credit card surcharges at 3%, meaning that if a merchant’s processing costs exceed this amount, the excess portion cannot be passed on to the patient.

Network and State Restrictions

The major credit card networks, such as Visa and Mastercard, impose specific requirements related to surcharge limits, advance notification, and disclosure.

In addition, several U.S. states and territories regulate or prohibit credit card surcharging. At the time of writing, credit card surcharging is prohibited in Connecticut, Maine, Massachusetts, and Puerto Rico. Other states, including Colorado, Minnesota, Mississippi, New Jersey, and New York, impose restrictions on surcharge amounts or require specific disclosures.

If your practice operates in a state that restricts or prohibits credit card surcharging, you must fully understand and comply with those requirements before implementing a surcharge.

Debit card transactions may never be surcharged, even if the debit card is processed as a credit transaction.

Applicability

Credit card surcharges may be applied only to credit card transactions. Other payment types, including debit cards and alternative payment methods, are not eligible for surcharging.

Regulatory Compliance

Merchants are responsible for maintaining ongoing compliance with all applicable card-network and legal requirements. This includes meeting advance notification obligations, using compliant signage and disclosures, adhering to surcharge percentage limits, and respecting jurisdiction-specific restrictions.

By following these guidelines, dental practices can implement credit card surcharging in a way that aligns with card-network rules and promotes transparency with patients. Clear and upfront communication helps maintain patient trust and supports a positive payment experience.